Blog Post

It has been three years since the last time we saw the Federal Reserve raise interest rates. Therefore, this announcement deserves a special edition. This report will describe what this decision means for both the market and your portfolio. So, skip to the last paragraph if you’re pressed for time and just what to know about just how to play the market.

On March 16, 2022, the Federal Open Market Committee announced that it would raise the target range for the federal fund rates from 0.25 basis points(bp) to 0.5% bp. However, last month that press release was only the official information release. It was only until Thursday, April 8, 2022, did the Fed released the meeting minutes, and all the speculation in the news was put to bed. As a result, we could now see exactly how and when the Fed was planning on executing its two charted mission of maximizing employment and inflation at two percent over the long run.

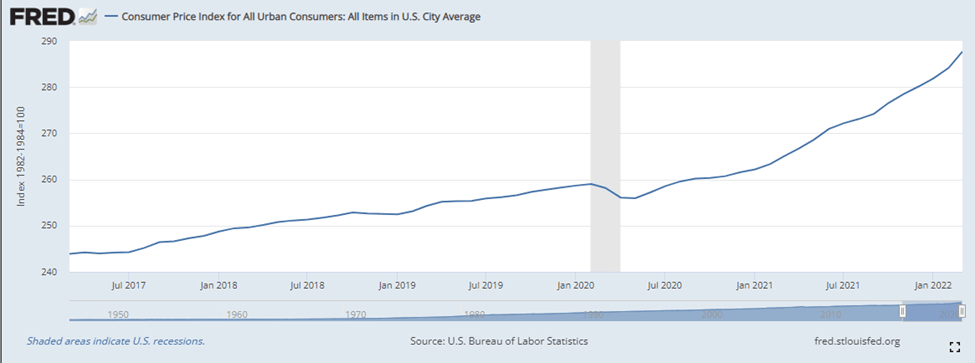

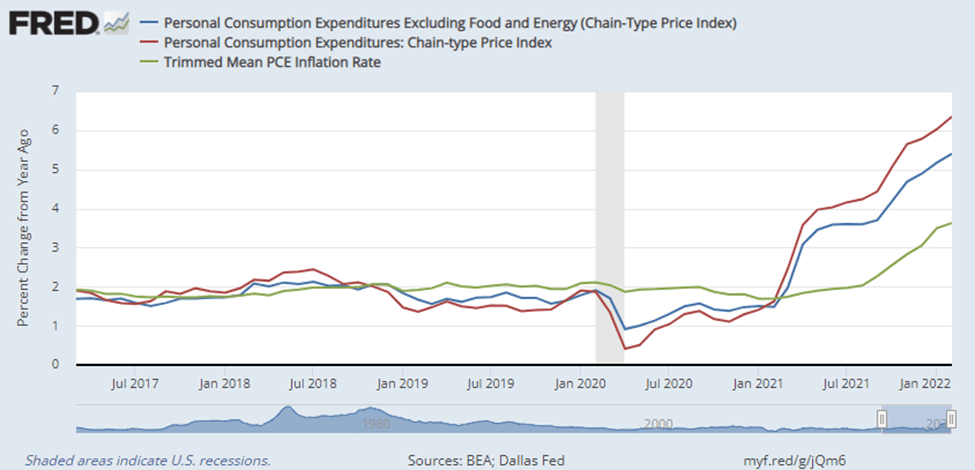

Today 4/12/22, the U.S. Bureau of Labor Statistics released March’s Consumer Price Index Report, is showing that inflation is at 40 years high at 8.5%. The BLS report is one of the U.S. Government’s primary inflation reports. The other is the U.S Dept. of Commerce’s Bureau of Economic Analysis (BEA) Personal Consumption Expenditures Price Index (PCE), which will come out on April 29, 2022. These two reports will be out before the Federal Reserve’s next meeting on May 3-4, 2022. Although the PCE is what the Fed determines inflation to be, the CPI is used to adjust Social Security Payments.

So, bottom Line upfront, the BLS and BEA reports are one of the two primary inflation assessments and other data sets that the Fed will consider regarding monetary policy.

Breakdown of Minutes and Reports and How it will impact Investors

Let us start with the FOMC meeting minutes. The Federal Reserve stated in their press release: “that the economy and unemployment have improved; however, Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures.” (Federal Reserve Press Release). The mention of fiscal policy, i.e., Federal spending, which had a significant cause, was absent from the report. 4.6 trillion dollars was spent in two years in response to COVID. We are apolitical here. We care about the return on investment, not politics. The 4.6 trillion of taxpayers’ money was passed by both a Republican and a Democratic President and by Members of Congress of both parties.

The Fed will raise federal fund rates from 0.25 bp to 0.5% bp in response to elevated inflation. In addition, the Fed’s Committee announced it would reduce its holdings of both Treasury securities and mortgage-backed securities at a coming meeting, likely the May 3-4,2022 meeting, if not earlier. As a result, expect to see anywhere from 2.0 to as high as 3.0 % interest raise by the end of the year. The wildcard is how fast and how often the Fed will raise rates.

The U.S Consumer Price Index March report came out today, April 12, 2022. As we mentioned earlier, the report showed the price index of inflation reached a 40-year high, for an official 8.5%, the most significant 12-month increase since December 1981. (BLS March Report Summary). The official report would have been higher but was not because used car prices were down -by 3.8%.

The de facto number is much higher, depending on your region. The de facto number is also higher because the energy index is up 32% over last year, and the price of food index is up 8.8%.

The cost of food will be higher due to the conflict between Russia and Ukraine. But also, due to some American crop yield problems that started in 2021. What does the battle have to do with the food price, you may ask? Russia and Ukraine and major grain suppliers between the two countries, control 25% of the world’s wheat market. In addition, Russia, Ukraine, and Belarus are major fertilizer producers, such as ammonia-nitrate, potash, and urea. The conflict has severely crippled the production capacity of both wheat and fertilizer. Even if production continues, getting it to the market becomes a problem. Most of the grain and fertilizer for those respective countries’ exports transit through the Black Sea via bulk ships. However, the Black Sea is now a war area, and it is complicated for shipping companies to get war insurance, let alone risk their ships and the lives of their crewmembers. We covered this topic in greater detail on our February 18, 2022, Weekly Recap, which was published before the conflict kicked off. On a sidebar you can go over to Marin Traffic, in the links below, and see the lack of shipping in the northern part of the Black Sea.

n addition to the CPI report released today, the White House announced today that “the EPA Administrator is planning to allow E15 gasoline—gasoline that uses a 15 percent ethanol blend—to be sold this summer.” (White House Press Release). The keyword in that statement is planning. We don’t know what the particulars of the wavier are since the EPA released no official report. The White House announced that this move would impact roughly 2300 gas stations nationwide. S&P Global and MSN worked the numbers- 2300 gas stations are only 1.5% of gas stations nationwide. More importantly, this announcement will have more impact on the price of food rather than the cost of gasoline. As we mentioned earlier, there is a shortage of both wheat and fertilizer around the globe, due primarily to the Ukraine-Russian War. Corn for ethanol production accounts for 30 to 40% of total corn production in the U.S. This announcement comes shortly before planting season. Here is how this matters, crops are a function of available real estate. A farmer only has a certain amount of land; if they choose to grow corn, they can’t grow soybeans or wheat. More available fertile land will go to corn and less for other crops. Corn also requires more fertilizer than other crops. Therefore, more fertilizer will get used for corn instead of other crops. To summarize, more corn will be grown for ethanol rather than feed. Therefore expect higher food prices, for both grain and protein, in the short term. The Wild Card is the actual crop yield during the fall harvest.

Bottom-Line up-Front Investors should expect greater volatility in the market for this quarter and likely for the rest of the year as the Federal Reserve tightens the credit markets. With inflation at 8.5% officially, cash is trash, aside from day-to-day expenses and emergency accounts. Holding excessive cash in the bank is a losing play, with an 8.5% decrease in purchasing power. Expect to see a further suspension of state taxes on necessary items such as gas and consumer staples, especially later in the year with upcoming elections. With the rising interest rates, smaller companies will have difficulty growing and expanding. Aside from the larger companies, research and development will take a hit. Expect to see poor cash balances on corporate earnings reports. Inflation will have a day-to-day effect on the market because it will be a daily headline both in the media and stopping at the gas pump and grocery store. Investors need a system that changes daily to adapt to the market. With rising interest rates and inflation, a single stock pick will not cut it. Investors need a portfolio with the most substantial companies to weather the inflation storm. That is where we come in. Our Top 35 Portfolio changes each market day that helps investors make sure they are allocating capital to the most robust companies currently in the market.

To Freedom and Capitalism.

Federal Reserve’s FOMC Press Release

https://www.federalreserve.gov/newsevents/pressreleases/monetary20220316a.htm

Federal Reserve’s FOMC Meeting Minutes

https://www.federalreserve.gov/monetarypolicy/files/monetary20220316a1.pdf

March 2022 Consumer Price Index Report- Bureau of Labor Statistics

https://www.bls.gov/news.release/cpi.nr0.htm

Bureau Of Economic Analysis

https://www.bea.gov/data/personal-consumption-expenditures-price-index

Federal Reserve FOMC Meeting Calander

https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm

Federal Spending on COVID-19

https://www.usaspending.gov/disaster/covid-19?publicLaw=all

Federal Reserve St. Louis Charts

https://fred.stlouisfed.org/series/PCETRIM12M159SFRBDAL

https://fred.stlouisfed.org/series/CPIAUCSL

Al Jazeera Article – Ukraine and Russia Wheat Market

Bloomberg Article – Ukraine and Russia Wheat Market

America 2021 Crop Yield Drought

https://www.reuters.com/world/us/drought-spreads-key-us-crop-states-2021-06-17/

USDA Feb 2022 Crop Report

https://www.nass.usda.gov/Publications/Todays_Reports/reports/crop0222.pdf

Ukraine and Russia Fertilizer Article

Black Sea Shipping Insurance April Article

Black Sea Shipping War Risk P&I clubs February Article

Marine Traffic Black Sea Shipping Traffic

https://www.marinetraffic.com/en/ais/home/centerx:36.4/centery:47.9/zoom:6

Ukraine Russia Conflict Map

White House Statement on EPA Ethanol 15 order

S&P Global EPA Order

E15 Gas Stations Article

Corn Production for Ethanol Chart

https://afdc.energy.gov/data/widgets/10339

Corn Fertilizer Requirements

https://cals.cornell.edu/field-crops/corn/fertilizers-corn

Gas Tax Suspensions Northeast and Georgia

https://www.cbsnews.com/news/connecticut-georgia-maryland-gas-tax-holiday/

Florida Gas Tax suspension in October

Posted: April 13, 2022

ETF Stock Report is located in South Florida, serving Florida investors in West Palm Beach, Fort Lauderdale, Miami, and stock traders Nationwide.

This copyrighted publication is published on financial market trading days by Celestial Creative Solutions, LLC., and is intended solely for use by designated recipients. No reproduction, retransmission, or other use of the information, images, graphs, or tables is permitted. Analysis is developed from data believed to be accurate, but such accuracy or completeness cannot be guaranteed. It should not be assumed that such analysis, past or future, will be profitable or will equal past performance or guarantee future performance or trends. All trading and investment decisions are the sole responsibility of the reader/investor/user. Inclusion of information about managed accounts program positions and other information is not intended as any type of recommendation. An advisor/client relationship is not created by the distribution or delivery of the reports. ETF Stock Report and Celestial Creative Solutions LLC., are not affiliated nor associated with Standard and Poor, Dow Jones, Nasdaq, nor CBOE-Chicago Board of Options Exchange (VIX). We reserve the right to refuse service to anyone for any reasons. The principals of Celestial Creative Solutions may have positions in the markets covered. Subscription cost: $50 per month. Subscribers paying monthly agree to accept automatic subscription renewal by credit/ debit card.

©2021-22, Celestial Creative Solutions, LLC. All Rights Reserved.